by Aleena Parvez | Oct 30, 2025

This presentation outlines crucial financial principles for CEOs, focusing on value creation, smart acquisitions, divestitures, compensation, and risk assessment. It presents four cornerstones of corporate finance: core-of-value, conservation-of-value, expectations-treadmill, and best-owner principle—guiding leaders to make strategic decisions that boost long-term shareholder value amid complex financial engineering trends.

by Aleena Parvez | Sep 22, 2025

Garden Ltd. case study focusing on operating leverage, financial leverage, and total leverage calculations. Includes sales scenario analysis, earnings per share impact assessment, and comprehensive module overview of financial planning concepts.

by Aleena Parvez | Sep 22, 2025

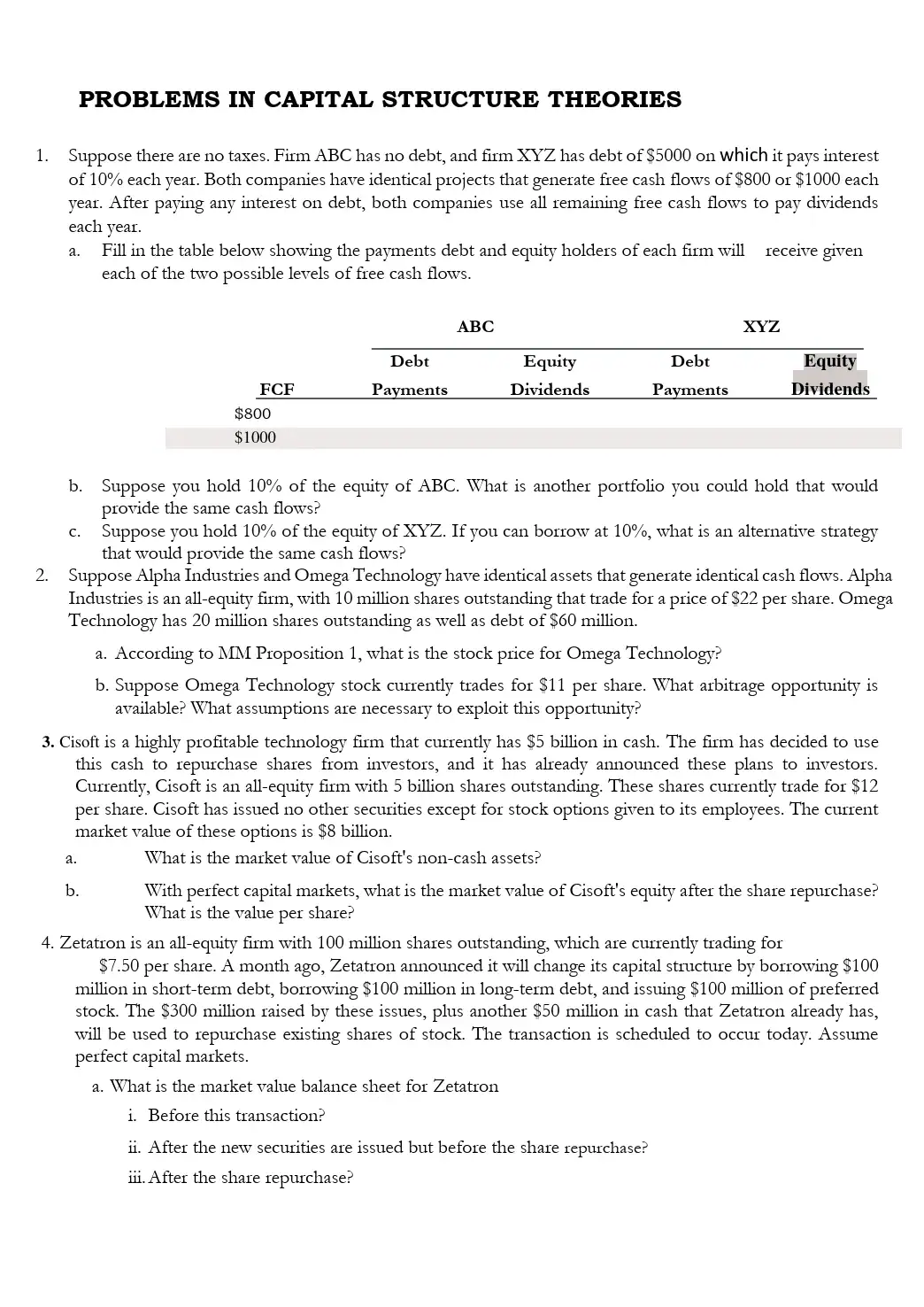

Problem-solving exercises on capital structure applications including EBIT-EPS analysis, debt impact on company risk, and leverage effects on investment decisions. Features comparative analysis problems and acquisition decision scenarios.

by Aleena Parvez | Sep 22, 2025

Practical capital structure decision-making covering EBIT-EPS analysis, cash flow approach, and valuation methods. Discusses business risk, operating leverage, financial leverage, and features of sound capital structure including return, risk, and flexibility.

by Aleena Parvez | Sep 22, 2025

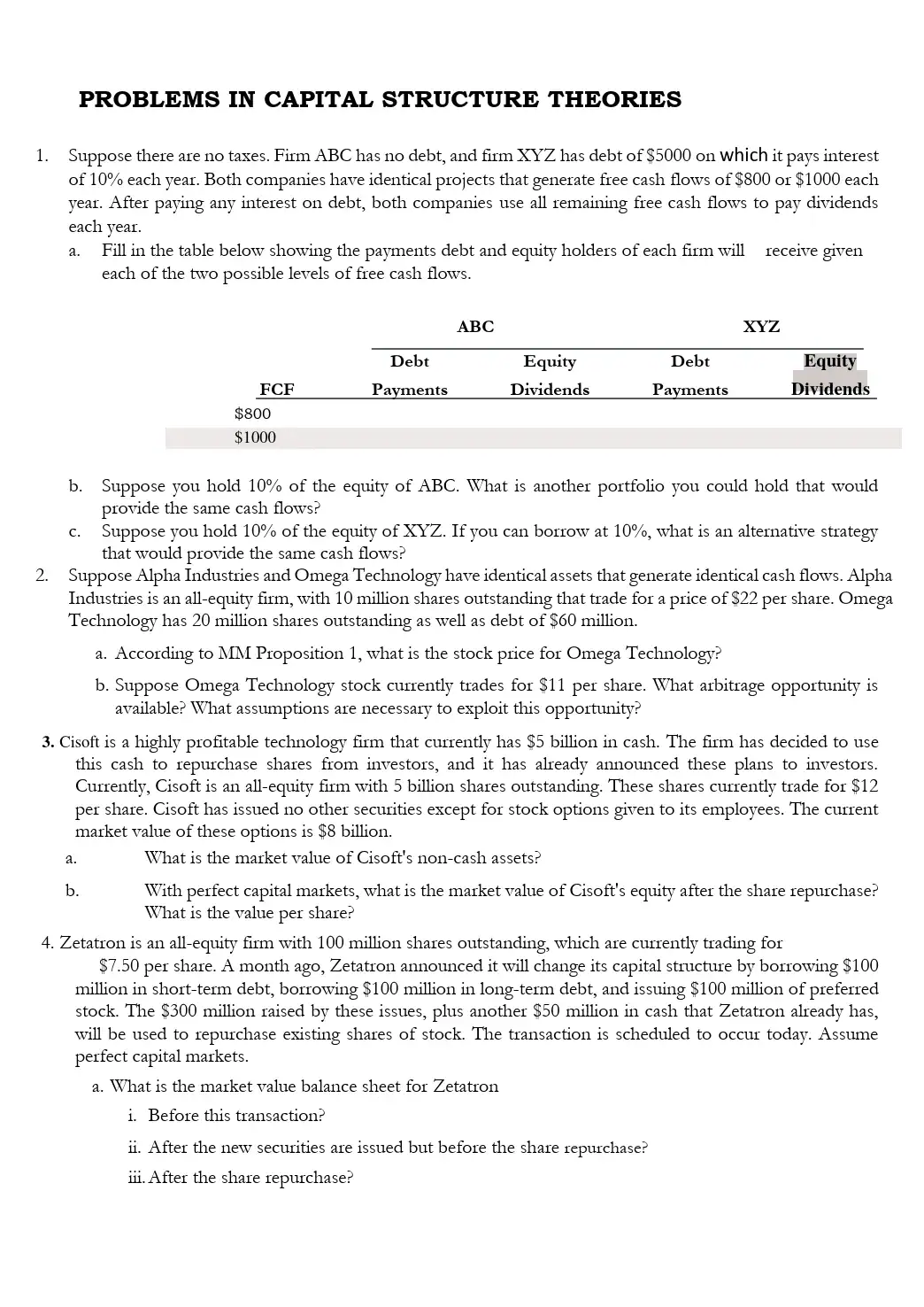

Capital structure theory problems covering MM propositions, arbitrage opportunities, debt-equity ratios, and risk analysis. Includes practical exercises on leveraged recapitalization, share repurchases, and WACC calculations for different capital structures.